By Sola Alabadan

The Chairman of FBS Reinsurance Limited, Mr. Bala Zakariyau has advised journalists to continue upholding the ethics of journalism profession, bearing in mind that journalism can make or mar a man.

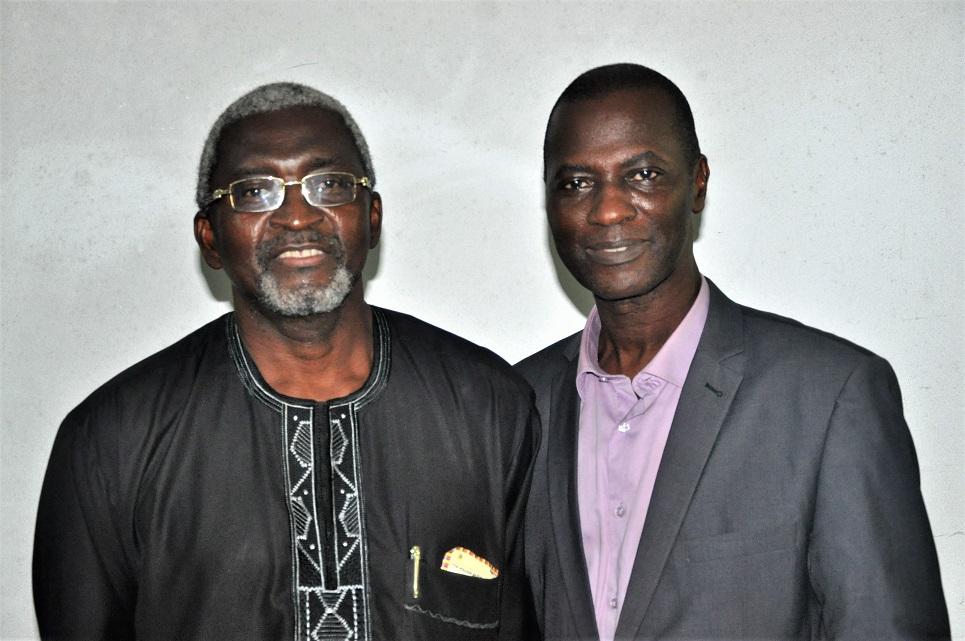

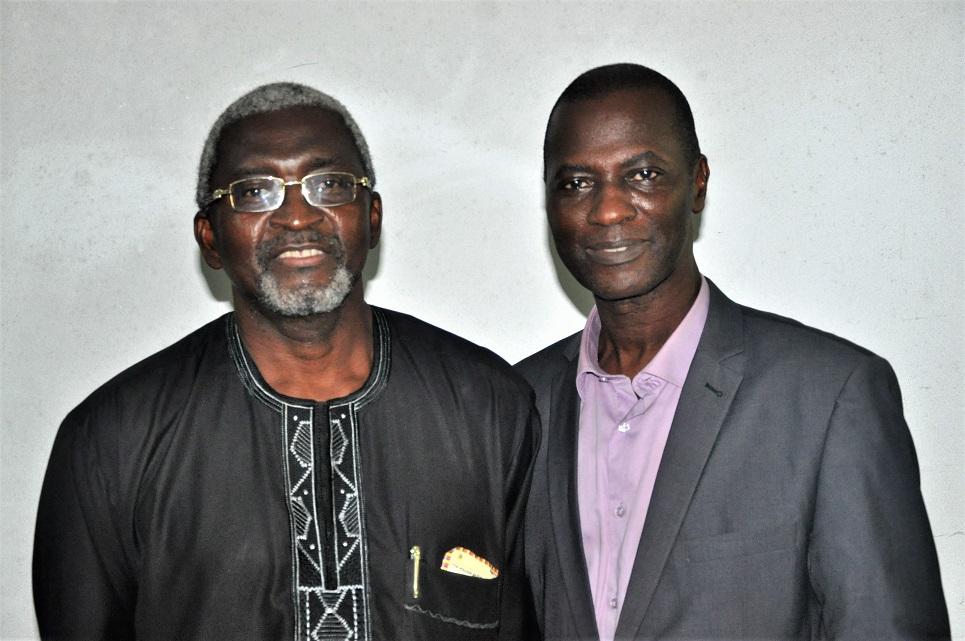

Zakariyau, who spoke when representatives of the Nigerian Association Of Insurance and Pension Editors (NAIPE) presented the 2025 Appreciation Awards to him in Lagos recently, said he was doing what he felt should be done all the while, without knowing that a body of journalists was observant of his activities.

He expressed his passion for the growth and development of insurance industry, especially, assuring that he is ever ready to support every stakeholder, including journalists, critical to the future of the sector.

While appreciating insurance journalists who have been reporting the sector for decades during good and bad times, he said: “the advice I would give you is to continue doing journalism in the most ethical way. The point I would like to emphasise is to continue to do the things that you are doing in the most ethical way. Journalism can make or mar a man, but be the one who uses journalism to make a man because history don’t forget people of such virtue.

“And the pretentional race is now becoming even more serious because of the digital environment we operate in through social media and once you say something bad about somebody, it goes viral. To me, if I am a journalist and I sent somebody through that stress, I may not be able to sleep. So, honestly I thank you very much on behalf of my colleagues on the board of FBS Re. ”

Earlier, the chairman of the 2025 NAIPE Annual Conference, Mr. Roland Okoro commended Zakariyau for changing the face of the industry and some innovations he brought on board during his time as the president of the Chartered Insurance Institute of Nigeria (CIIN). He also appreciated his professionalism and managerial acumen as the managing director/CEO of the defunct Niger Insurance Plc, as well as other positions he occupied in the industry.

Similarly, the chairperson of NAIPE, Mrs. Nkechi Naeche-Esezobor said, he was found worthy as one of the six personalities who deserve to be commended for their selfless service to the nation’s insurance industry, as the association celebrate 10 years of the annual conference, adding that, ‘the consensus was that you deserve this award looking at your pedigree and impacts you have had and continue to have in the insurance landscape.’

According to her, “the Association counts you worthy of its highly esteemed award, following your track records as the former President of the Chartered Insurance Institute of Nigeria(CIIN) and leadership role across the industry including as MD/ Chairman of renowned Insurance Companies, including FBS Re, where you are currently the Chairman.”

Zakariyau has over 40 years of experience in the insurance sector in Nigeria and has served on the Boards of more than 20 national and multinational institutions. He is a Fellow of the Chartered Insurance Institute of Nigeria, Fellow of Nigeria Institute of Management, Fellow of the Institute of Marketing and Fellow of the Institute

of Directors.

He is the current President of Lagos

Business School (AMP4) and a member of the Governing Council of the Alumni Association (LBSAA). He was a Past President of the Chartered Insurance Institute of Nigeria. He holds an Associateship of the Chartered Insurance Institute of the UK and a Masters degree in Business Administration.

He has held various Senior and Management positions in the insurance sector before joining Niger Insurance Plc as a General Manager (Technical) in 1993. Due to the recognition of his professionalism and hard work, he quickly rose to the Executive Director Position that same year.

In 1997, he was appointed Managing Director of the company. After nine years of successfully heading the company’s affairs, he was appointed as Chairman of the company’s Board in 2006. He retired in December 2015 after 22 years of meritorious service to Niger Insurance.