The federal government has been charged to give due consideration to improving on the welfare of pensioners and workers as the new administration is striving to address observed challenges in the nation’s economy.

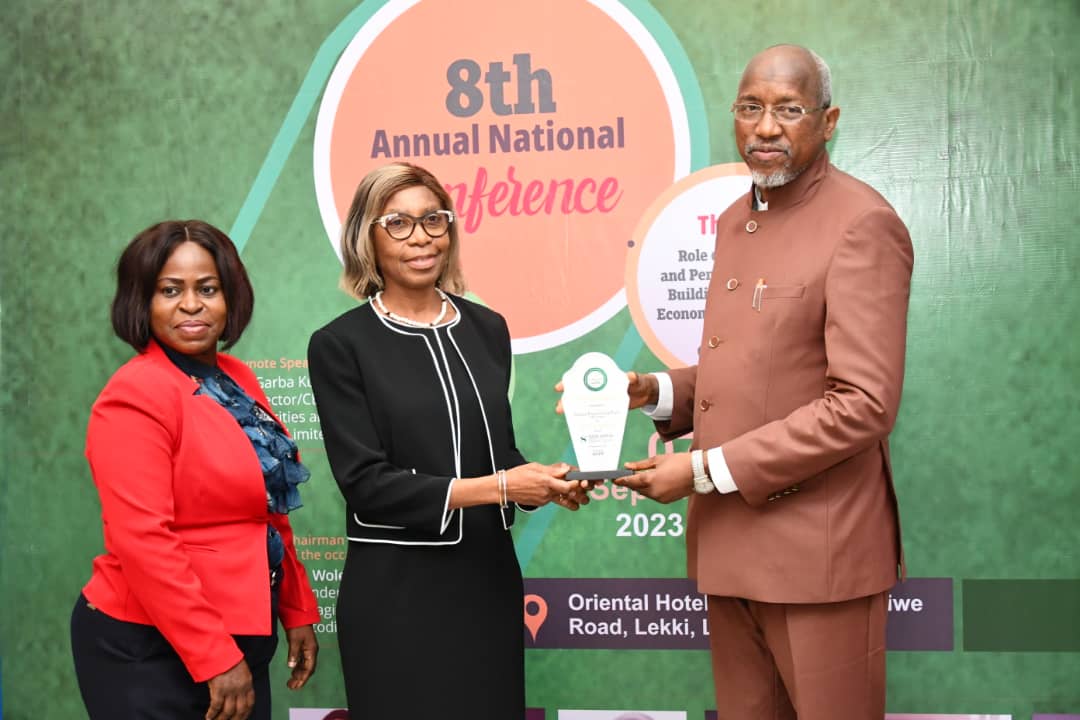

Nigerian Union of Pensioners Contributory Pension Scheme (NUPCPS) gave this advice at the 8th Annual National Conference of the Nigerian Association of Insurance and Pension Editors (NAIPE) in Lagos.

The conference’s theme was: “Role of Insurance and Pension In Building Sustainable Economic Growth Under The New Government.”

The secretary of NUPCPS, Bisan Olufemi John, said the pension arrangement by the government was still far from being favourable to retirees.

He stated that there was no way the government can successfully tackle the economy without adequately satisfying the yearnings of both pensioners and those currently in service.

According to him, “the Federal Government has been struggling with getting the economy to work, but one thing that is clear is that the people are the ones that will contribute mainly to make such a reality.

“The government must first think of the workers, improve their welfare so they can then contribute their quota adequately to the economy. It should be the people before the economy.

“Government should think of how to build the operators of the economy and also improve the life of pensioners.”

While recalling the failure of government to pay Group Life Insurance claims to next of kin of deceased civil servants, he also lamented the perceived conflicts in annuity for pensioner under failed insurance companies.

He further called on the government to provide better opportunities for pensioners to be happy, saying that retirees’ welfarism should not just end at the level of being paid their stipends.

Speaking in the same vein, another retiree, also a member of NUPCPS, Comrade Olagbayo Johnson. O., said it was unfortunate that the current Contributory Pension Scheme (CPS) appeared to be failing.

Giving a background to the reason behind the scheme, he said it was the failure of the Defined Benefit Scheme, which is government funded, that compelled the Federal Government to visit Chile to do a check on how the contributory scheme worked.

He, however, lamented that since Nigeria started the scheme in 2004, it had shown little or no difference from the old scheme apart from the fact that employees and employers now contribute towards the pool of funds.

He pointed out that it was the more reason some individuals and institutions were agitating to pull out of the scheme.

According to him, “imagine, National Assembly workers, those are the people who made the law, they are agitating to pull out of the scheme. The military has long left and even the police are on the verge of pulling out.

“Why is this one different from that of Chile? Their own that we copied from is still working.”

On her part, the Chairman, Nigeria Labour Congress (NLC), Lagos Chapter, Funmi Sessi, lamented that Nigerian pensioners were still far from having the deserved rest, adding that there was need for them to earn their benefits, rest and enjoy the fruit of their labour.

She condemned the poor approach by Pension Fund Administrators (PFAs) to paying benefits to pensioners.

She also specifically condemned the difficult process in accessing benefits by relatives of deceased worker, stressing that the request for a letter of administration and other documents should be made easier.

Also speaking as one of the participants at the event, the Local Chapter Chairman, Nigeria Association for the Blind, Ifako Ijaiye Chapter, Anuoluwa Yinka Isaac, said it was disturbing that Nigerian pension and insurance system does not have special products for the physically challenged in the society.

He observed that those in that category were left out in so many arrangements in the country, stressing that on so many occasions they would have to work out arrangements to live in the society that is almost hostile and unresponsive to the plight.